Make Better Risk

Decisions with

EMV 3-D Secure

At PAAY we make customer authentication easy so that you can focus on managing risk and protecting revenue.

DocumentationLosses with PAAY

- 01 Cardholder enters cart checkout

- 02 Authentication occurs behind the scenes

- 03 Transaction is sent for processing

.jpg)

.jpg)

with PAAY

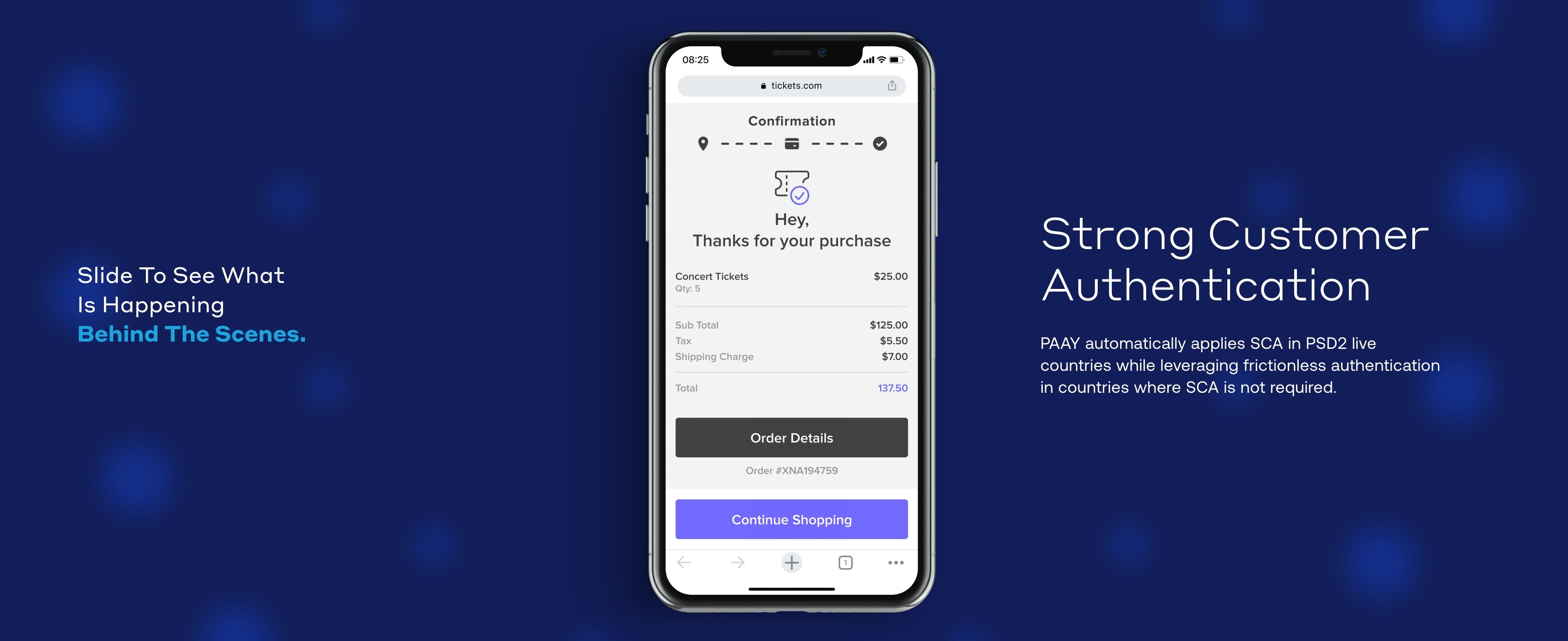

As of now, EMV 3DS is the only tool available to perform SCA on purchases made via credit card for PSD2 compliance.

PAAY supports SCA by enabling the use of two-factor authentication. Its flexibility allows issuers to accommodate their authentication preferences, and using risk and regulatory factors, issuers decide how the customer will be authenticated. For example, using a one-time-passcode, knowledge-based questions, or biometrics.

Schedule a Free Consultationfor PSD2 & Beyond

PAAY automatically applies SCA in PSD2 live countries, and helps you manage exemptions while leveraging our frictionless authentication in countries where SCA is not required. Using knowledge of the card issuer’s behavior, PAAY optimizes the customer experience while protecting your sales.

SPEED & ACCURACY

...are most relevant. Work with PAAY to leverage authentication data and optimize your fraud strategy.

Schedule a Free ConsultationThe Credit Card Frictions report focuses on how frictions associated with credit card use (such as transaction declines and disputes) impact consumer perceptions of the parties involved in these transactions. The report is based on a survey of more than 2,000 U.S. consumers who engage in online shopping.

Download

Our Solutions

Subscribe

Join our newsletter to stay up to date on features and releases

©2025. All rights reserved Privacy Policy